Financial Models

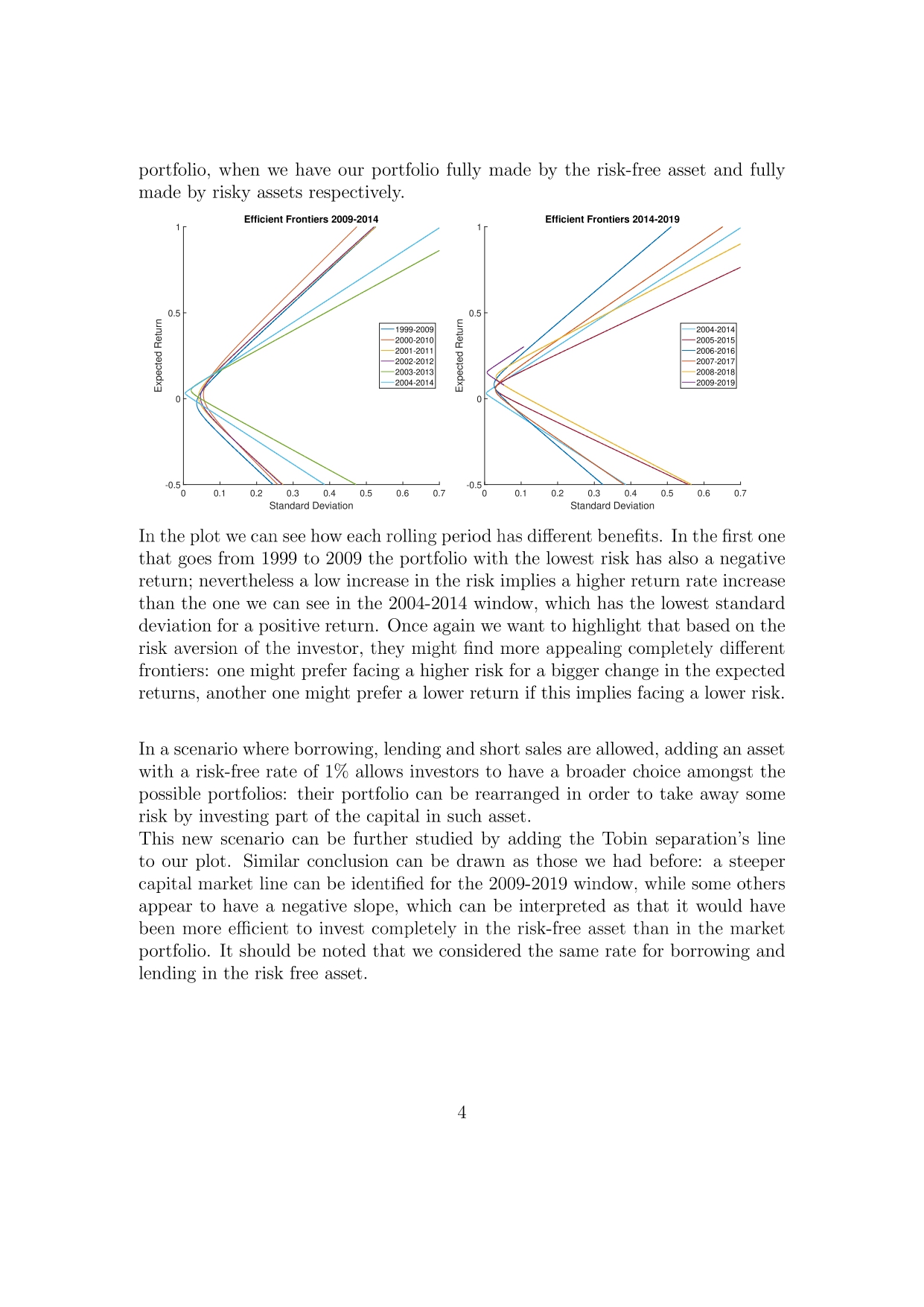

We have build optimal portfolios made by a certain list of assets based on data that we have collected from the Yahoo! Finance database.

This let us study and compare how predictions based on historical data would have performed against the real outcomes of markets' changes.

We then focused on understanding how would one need to act in order to keep up with price changes and what would that imply on portfolio's composition.

Alongside this we also have done a study on real world bonds and what the optimal strategy would be for an optimal portfolio of such.

The project has undergone a very strict review as it was the starting point for one of my exams at Københavns Universitet.

This has been a project that made finally possible for me to connect several of my passions: financial analysis, mathematical modeling and coding.

If you are interested to read the report, click this.